On purchase & refinance loans

Point of contact throughout

Serving Chicagoland & beyond

Calculate how much your monthly mortgage payment could be.

*Results are estimates and may not reflect your specific situation. This is not a commitment to lend nor a pre-approval. Call for full details.

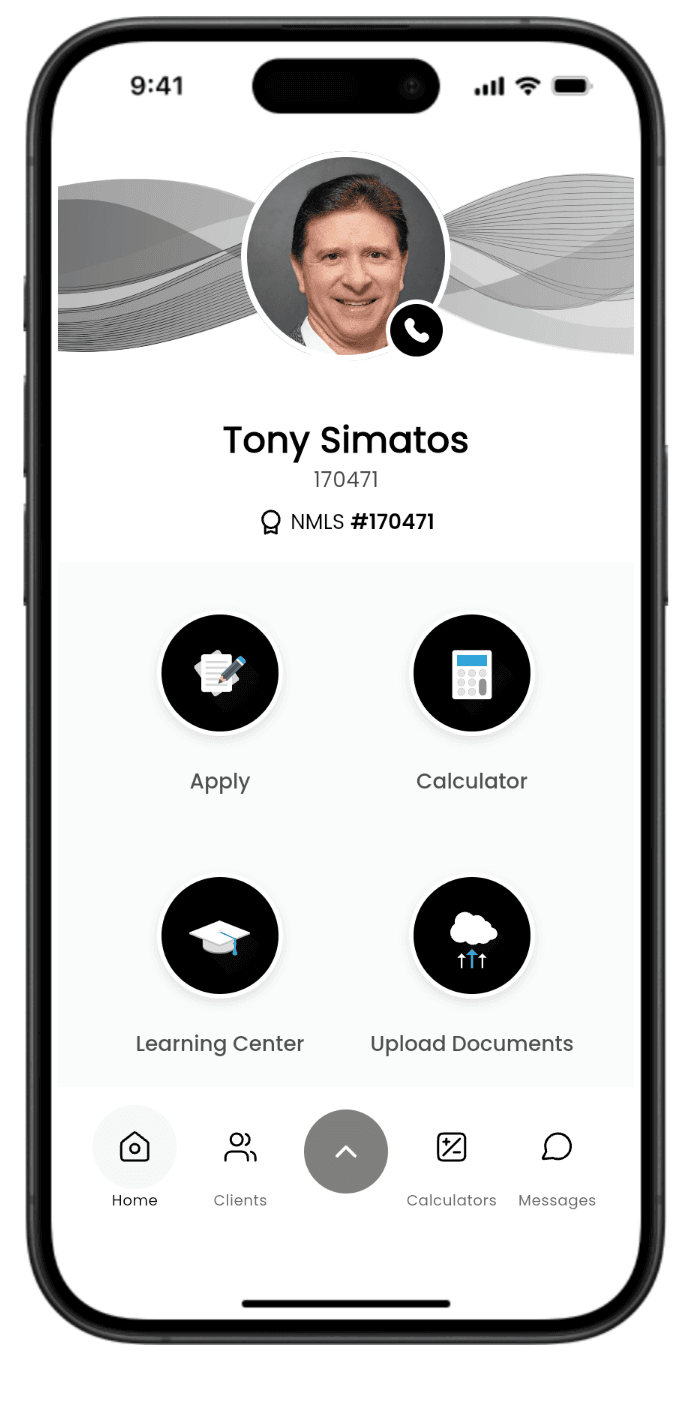

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

Monday - Friday 9 a.m. - 7 p.m.

Saturday - 9 a.m. - 3 p.m.